Today’s customer is channel-agnostic, switching effortlessly between online and bricks-and-mortar buying and employing a blend of shopping techniques: patronizing physical stores for tactile and social experiences, conducting product/pricing research via smartphone, and taking advantage of super-convenient online ordering and delivery options. Customers value experiences, and the quicker retailers can reduce its points of friction, the better future proof they will be.

Despite the rise in e-commerce, the physical retail channels still play an important role in consumer experience and retailers are increasingly looking to technology to keep them afloat. Technological experiments are usually born out of a retailer’s desire to improve speed and convenience for customers while reducing their own costs and inefficiencies.

Strangely, at a time when more and more of us are getting our products online, or delivered to our home, an eruption in new retail shopping is emerging. This is causing many traditional brick and mortar retailers to shift their focus again, from traditional stores to online shopping and now to automated stores.

There is a range of technologies driving the cashier-less retail industry and these range from the unobtrusive to the privacy-invasive kind.

Here are some technologies driving the next evolution in retail experiences:

- Machine vision: A subset of AI, machine vision allows computers to understand images. Customers are tracked through the store once they scan a code on their phones in order to link their physical presence with their identity. Machine vision also allows the store to track the movement of products through the store.

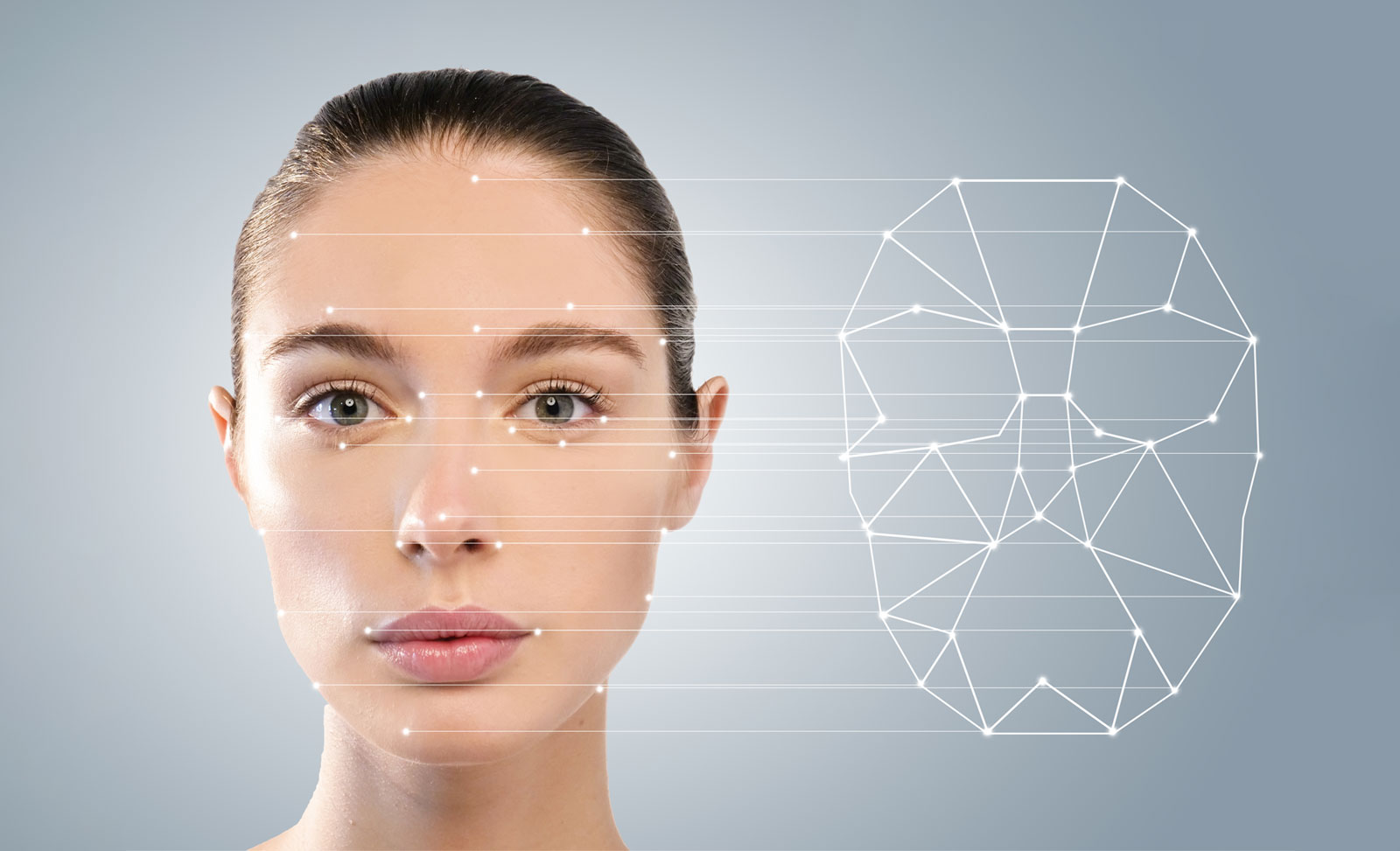

- Facial recognition: Quite evolved in the Chinese marketplace, facial recognition enabled cameras to allow stores to identify shoppers along with names and their identities.

- Shelf sensors: Smart shelves equipped with weight and light sensors automatically track when a product is lifted off a shelf or put back. The sensors can also automatically alert staff when products are sold out thus streamlining inventory.

- Barcodes: Mobile apps, that let shoppers scan product barcodes themselves and pay, can support unmanned checkout.

- QR codes: Mobile apps generate unique QR codes for shoppers with they enter the store, pay and exit. This allows consumers to pay through their favourite payment apps while also being able to explore detailed product information.

- RFID tags: Radio frequency ID tags can be attached to products to track them through stores. Sensors at store exits can read RFID information to confirm what products a shopper is carrying out with them. Though impractical for low-cost items, RFID tags provide an extra layer of security for retailers that stock higher-priced goods.

Cashier-less models have become the cutting-edge area of the retail industry with a number of pioneers making big moves. From the much-publicized

Amazon Go – Shoppers can enter the store only if they have the Amazon app on their phones and get charged as they pick up items and exit. The store uses shelf sensors and cameras to track people and the products they interact with. Human staffers help shoppers find products, prepare fresh food and check IDS in the alcohol section.

Alibaba – The Chinese retail bemouth has a chain of cashless grocery stores called Hema that operates across 65 locations in China. Through the Hema app customers can discover product origins, order food at the in-store restaurant, check out and pay for products and even order 30-minute delivery options at home or for pick up. Certain locations also allow customers to pay by scanning their faces.

JD.com – A human-free convenience store in Shandong, China it allows customers to scan their phones to enter and again to pay and exit. Similar to Amazon Go (though they opened before Amazon Go) the stores use shelf sensors, cameras and facial recognition tools, and RFID tags to track people and products.

BingoBox – Has 300 convenience stores across China generates unique QR codes which coupled with instore cameras track shoppers through the store. Remote employees can use a video live stream to chat with customers who need help through their shopping visit. They are even exploring facial recognition software to identify shoppers by face. 24*7 open with no workforce.

Cargo – The US-based start-up places the unmanned point of sales units within ride-sharing vehicles. It gives drivers boxes to put on their car consoles, which stock snacks, drinks, personal care products, and other items. Riders can download the Cargo app, scan the QR code on the box, and pay through the app to open the box and take items. Brands such as Kellogs and Advil are some of the few, others even offer free samples through Cargo in order to bolster their data gathering efforts during test phases.

7-Eleven – Pilot stores in South Korea are shaped like trains and contain digital vending machines carrying 40 products each. This has been created in a way that will allow them to be added to traditional stores. Trials were conducted to test HandPay, a biometric identification platform enabling customers to pay with their hands.

Sam’s Club – A sub-brand of Walmart Sam’s Club Now has installed 700 cameras through the store that allows shoppers to interact with products through the Scan and Go app and pay on their way out. Its membership-only chain allows them more efficiencies as they know a lot more about their customers and their preferences. The app also comes along with a voice command option that leads customers to specific items, so they do not have to search the aisles ever again.

Smartcart by IMAGR – IMAGR is a New Zealand based company promising a cost-efficient way for retailers to go cashless while removing the need for checkout lines. Retrofitting shopping carts with image recognition and artificial intelligence enables sensors, shoppers pair their smartphones with their carts and products are automatically billed when they walk out of the store. Forecast to be trailed at Four Square Ellerslie this is a local brand to keep an eye out for.

The biggest element of change that cashier-less retail is most evident is that consumer add-on sales will be reimagined. The traditional impulse zones will need to evolve, taking into consideration that shoppers are now walking in and out of stores with reduced dwell time. Shoppers will not be tempted to pick up that impulse product while waiting in the check-out line since the check-out line no longer exists. Think magazines, mints, chocolates and candy, the self-checkout environment need to take these last-mile products into consideration.

Another change would be the lack of personal interaction that trained cashiers are so good at especially when the transaction is more than one or two items. The role of staff within retail environments will shift from transactional interaction to either playing a restocking inventory role or one where they can play a more personalised vale addition role in assisting shoppers. Theoretically, the cashier-free model frees up employees for deeper interactions with shoppers, supporting more concierge services and personalized offerings. If you think about it, focusing human talent on creative emotionally engaging work and shifting tedious duties to AI is a smart move for retailers, a move that would be better for stores and better for customers.

While cashier-less models continue to attract a lot of attention, models have to prove that they can perform effectively at scale in order for adoption to become widespread. While the delivery side is only one side of the coin, the big question is while shoppers be willing to adjust? Despite the fear of being watched, consumers have shown they are willing to accept tradeoffs in privacy for convenience. New store concepts have historically been successful when targeted towards specific customer segments.

A useful precedent is the ATM. Banks feared a loss of brand loyalty with new faceless technology, but the speed of interaction won, where the customer experience was key. While some shoppers like being in control of their entire shopping experience, others may feel less comfortable using an app and prefer interacting with human beings. The balance of change to familiarity in the retail industry is littered with promising technologies that were launched with great fanfare but did not become mainstream as it did not sufficiently benefit the retailer of the consumer. Either the technology did not save the retailer enough or generate enough new revenue or the customer simply did not like it. Typically, for a technology to become the new normal it has to make it beyond the early adopters – typically 10 to 15% of retail shoppers – and appeal to the less tech-savvy majority.

Will 2019 see an increase in innovation in cashier-less checkouts within New Zealand retail landscape, or will we wait to learn from first adopters in the category? We are rooting for homegrown tech to rise up and make all our shopping experiences a breeze.